Solving Repetitive KYC Fatigue: Sumsub Introduces Reusable Digital Identity Product Suite

Sumsub, a global full-cycle verification platform has launched its Reusable Digital Identity product suite.

KYC is essential for security, fraud prevention and com

pliance. However, when users need to verify their identity repeatedly across multiple services – especially when seeking critical access to financial or transportation apps – it creates friction and frustration. This repetitive process often leads to high drop-off rates and less user interest, impacting both user experience and business conversion rates. At the same time, all of the checks required for ensuring a compliant verification must still take place.

Sumsub is processing millions of identity checks weekly, and aggregated data analysis reveals that one in three applicants have verified previously with Sumsub, highlighting the recurring KYC issue. To address this, Sumsub has launched a combined product to help both individuals and firms alike avoid repetitive verification steps while ensuring full compliance and security.

The challenges of identity verification are particularly acute in Africa, where financial inclusion remains a major concern. According to the World Bank, over 350 million adults in Sub-Saharan Africa lack access to formal financial services, often due to difficulties in verifying their identity. Many people rely on informal banking systems or cash-based transactions, making it harder for financial institutions to onboard new users efficiently. Sumsub’s Reusable Digital Identity aims to remove as much existing friction as possible by providing a seamless, secure, and efficient way to verify identities. This removes the need for redundant document submissions, making financial services more accessible across the continent.

“As Africa continues to embrace digital transformation, ensuring seamless and secure identity verification is critical for economic growth,” says Hannes Bezuidenhout, Sumsub's VP of Sales for Africa. “By eliminating redundant KYC checks, we are not only improving user experience but also supporting financial inclusion by making it easier for individuals and businesses to access essential services without unnecessary delays and entry barriers.”

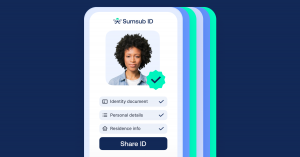

The Reusable Digital Identity product suite includes two products, Sumsub ID and Reusable KYC. Both of them enable end-users to skip cumbersome verification steps such as document uploads, while at the same time ensuring that all checks required for regulatory adherence for businesses still take place. Sumsub ID enables end-users to securely store and re-use their verified documents for multiple verifications across Sumsub client platforms, whereas Reusable KYC allows companies in the Sumsub ecosystem to agree to share applicants’ data upon receiving their consent. While each product has a unique approach to the same challenge, both of them further enhance customer experience while ensuring full compliance and adding an extra layer of security. By offering faster and more efficient ways to verify identities, Reusable Digital Identity is designed to help users avoid unnecessary document uploads and repetitive data input procedures–while, at the same time, speeding up applicant onboarding and enhancing conversion rates for companies.

Key benefits of Sumsub Reusable Digital Identity products for businesses are:

- Higher pass rates: businesses see up to 30% improvement in successful user verifications.

- Faster KYC processes: Sumsub ID reduces onboarding time by 50%, improving conversion rates.

- Full Compliance & Security: Both Reusable KYC and Sumsub ID are GDPR-compliant and built to enhance fraud prevention.

Main benefits for users are:

● Seamless verification: individuals can breeze through KYC by re-using their documents from previous verifications with Sumsub.

● Full privacy and security of personal data stored or shared by third parties for verification purposes.

● Less time spent on getting access to the platforms and services people use, as both Sumsub ID and Reusable KYC make the onboarding process faster by eliminating redundant document uploads.

How Sumsub Reusable Digital Identity product suite works:

1. Sumsub ID allows applicants to onboard onto a platform within the Sumsub ecosystem, securely store their verified documents, and reuse them for future verifications across 4000+ companies which also use Sumsub;

2. Reusable KYC enables companies to share users’ personal data with their explicit consent, ensuring quicker onboarding which benefits companies and individuals alike.

To learn more about Reusable KYC offering, please visit https://sumsub.com/reusable-kyc/

Tishala Communications

Tishala Communications

+27 71 628 6231

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release