Debt Collection Agencies Market to Grow to US$41.7 Bn by 2033, North America Leads with 40%

Debt Collection Agencies Market Size

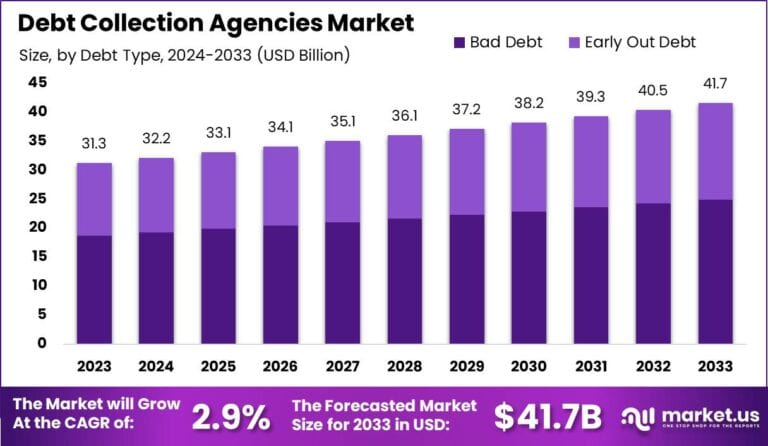

Global Debt Collection Agencies Market set to grow to USD 41.7B by 2033 from USD 32.2B in 2024, at a CAGR of 2.90%.

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The debt collection agencies market comprises organizations specializing in recovering unpaid debts on behalf of creditors across various sectors, including banking, healthcare, retail, and utilities. These agencies employ a range of strategies, including negotiation, legal actions, and advanced technologies, to recover outstanding payments efficiently.

The market is driven by increasing consumer debt levels globally, fueled by the growth of credit card usage, personal loans, and student loans. Additionally, the rising need for businesses to maintain cash flow and reduce bad debt losses has intensified the demand for debt collection services. Regulatory frameworks mandating compliance and ethical practices also support the market’s formalization and growth.

Artificial intelligence (AI) is significantly transforming the debt collection industry. AI-powered tools enable agencies to optimize their operations by automating repetitive tasks such as debtor segmentation and payment reminders. Predictive analytics and machine learning algorithms allow agencies to assess debtor profiles and tailor strategies for better recovery rates. Chatbots and virtual agents enhance customer interaction, ensuring more efficient and personalized communication.

To remain ‘ahead’ of your competitors, request for a sample @ https://market.us/report/debt-collection-agencies-market/request-sample/

The demand for debt collection agencies is growing, especially in emerging economies, where rising disposable income has led to increased consumer credit. Technological advancements like cloud-based solutions, blockchain for secure transactions, and advanced data analytics further streamline processes, improve transparency, and enhance debt recovery rates.

Key Takeaways

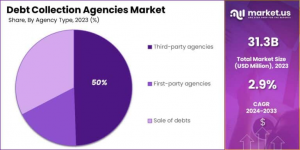

In 2023, Third-party segment held a dominant market position, capturing more than a 50% share of the Debt Collection Agencies Market.

In 2023, Bad Debt segment held a dominant market position, capturing more than a 60% share of the Debt Collection Agencies Market.

In 2023, Financial Services segment held a dominant market position, capturing more than a 25% share of the Debt Collection Agencies Market.

In 2023, North America held a dominant market position in the global debt collection agencies market, capturing more than 40% of the share.

According to NASACT, there are majorly 3 forms of business model for collecting debts, Individual Agency (33%) Centralized Function for Multiple Agencies (17%), and Combination of Models (50%).

Analyst’s Viewpoint

The debt collection agencies market is undergoing a huge transformation, driven by rising consumer debt levels, regulatory mandates, and technological advancements. From an investment perspective, the market presents significant opportunities, particularly in emerging economies where expanding consumer credit and digitalization of financial services are boosting demand for efficient debt recovery solutions. Investors can leverage the growing adoption of AI and machine learning technologies, which enhance operational efficiency and debtor profiling, reducing costs and improving recovery rates. Furthermore, the integration of blockchain for secure and transparent transactions presents a novel avenue for innovation and differentiation in the market.

However, the industry is not without risks. Regulatory scrutiny surrounding ethical debt collection practices poses a challenge for agencies to remain compliant while achieving profitability. The growing consumer awareness about their rights and privacy concerns also compels agencies to adopt more transparent and customer-centric approaches. Government incentives in certain regions, such as tax benefits or funding for digital infrastructure development, are encouraging market growth. However, regulatory environments vary significantly across countries, requiring market players to navigate a complex legal landscape.

Technological innovations, such as cloud-based debt collection platforms and advanced analytics, are driving market competitiveness and enabling scalability for small and medium-sized players. While the market holds substantial growth potential, successful navigation of regulatory compliance, ethical practices, and technological investments will be critical for sustained success. The focus on building trust through consumer-friendly practices and leveraging cutting-edge technology will remain pivotal in shaping the future of the debt collection agencies market.

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=134591

Report Segmentation

Agency Type Analysis

In 2023, the third-party agencies segment held a dominant market position, capturing more than a 50% share of the debt collection agencies market. This dominance is attributed to the outsourcing preferences of businesses seeking cost-effective and specialized debt recovery services. Third-party agencies offer expertise in handling complex collections and navigating regulatory compliance, making them a preferred choice across industries such as banking, healthcare, and retail. Their ability to work on a contingency fee basis further reduces financial risk for creditors, driving their widespread adoption.

The first-party agencies segment, also tends to plays a crucial role in maintaining customer relationships. These agencies act as an extension of a company’s in-house operations, ensuring early-stage debt recovery with minimal disruption to client relationships. Businesses with a strong focus on brand reputation and customer loyalty often utilize first-party agencies for a more personalized approach to debt collection.

Moreover, the sale of debts segment is gaining traction as a viable alternative for creditors looking to offload non-performing accounts altogether. This approach allows creditors to recover a portion of their losses upfront by selling delinquent accounts to specialized buyers, who assume the risk of collection. Although this segment represents a smaller share of the market, it is expected to grow as creditors increasingly explore risk-averse strategies to manage bad debts.

Debt Type Analysis

In 2023, the bad debt segment held a dominant market position, capturing more than a 60% share of the debt collection agencies market. This dominance is driven by the growing prevalence of non-performing loans (NPLs) across various sectors, including banking, retail, and healthcare. Bad debts, are typically long overdue and deemed challenging to recover, necessitate specialized expertise and advanced tools, making them a key focus area for debt collection agencies. The increasing volume of bad debts in the emerging markets majorly due to the rising consumer credit, and stricter regulatory requirements for debt management, has further amplified the demand for professional debt recovery services.

The early out debt segment, although smaller, plays a critical role in debt management by focusing on recovering delinquent accounts during their initial stages of delinquency. This proactive approach not only improves recovery rates but also minimizes the risk of accounts transitioning into bad debt. Early out debt services are particularly attractive to businesses looking to maintain strong customer relationships, as the communication is less intrusive and focuses on resolution rather than enforcement.

Application Analysis

In 2023, the financial services segment held a dominant market position, capturing more than a 25% share of the debt collection agencies market. this could be attributed to the financial service sector’s high volume of non-performing loans (NPLs), credit card law-breaking, and personal loan defaults. Financial institutions, including banks and credit unions, rely heavily on debt collection agencies to manage their portfolios of overdue payments, maintain liquidity, and reduce bad debt write-offs. The stringent regulatory environment surrounding financial services also necessitates specialized expertise and compliance-driven recovery practices, further driving the demand for professional agencies in this segment.

The healthcare sector represents another significant application area, driven by the rising volume of unpaid medical bills and insurance claims. Student loans are a growing segment, particularly in regions with high levels of educational debt, such as the United States, where collection agencies play a vital role in recovering overdue accounts.

Moreover, the government segment is gaining traction as agencies assist in recovering unpaid taxes, fines, and other public dues, while the retail sector increasingly depends on debt collection services to address defaults from buy-now-pay-later (BNPL) schemes and store credit offerings. Similarly, the telecom and utility sectors face challenges with unpaid service bills, further boosting the demand for collection services. Mortgage and "other" applications, including small business loans, also contribute to market growth, albeit on a smaller scale.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/debt-collection-agencies-market/free-sample/

Regional Highlights: A Global Perspective

In 2023, North America held a dominant market position in the global debt collection agencies market, capturing more than 40% of the share. This is driven by the region's mature financial services industry, high consumer debt levels, and robust regulatory frameworks. The United States, in particular, accounts for the largest share, supported by the widespread use of credit cards, personal loans, and student loans.

Expanding end-use industries such as healthcare and retail are also contributing to market growth, as rising healthcare costs and the proliferation of buy-now-pay-later (BNPL) schemes generate a higher volume of overdue accounts. Additionally, the growing adoption of AI-driven debt collection technologies by agencies in the region is enhancing operational efficiency and compliance, further bolstering market demand.

The Asia Pacific (APAC) region is emerging as a profitable market for debt collection agencies, primarily due to rapid economic growth, increasing consumer credit penetration, and expanding financial services industries in countries like China, India, and Southeast Asian nations. The rising adoption of digital payment systems and financial inclusion initiatives are fuelling credit uptake, which, in turn, is increasing the volume of overdue payments.

The retail and telecom sectors are experiencing robust growth in the region, leading to a surge in demand for debt collection services to manage delinquent accounts. Additionally, the healthcare sector is expanding, particularly in developing economies, where medical debt recovery is becoming an essential service. The growing investment in technological advancements, such as cloud-based platforms and AI-powered analytics, is further strengthening the capabilities of debt collection agencies in the region.

Key Player Analysis

One of the leading player in the market is Capital Collections LLC, a third party debt collector based in Fresno, California. The firm specializes in the recovery of various types of debts, including commercial, tenant/landlord, retail, medical, municipal, government, transportation and agriculture.

Another prominent player in the market is Aspen National Financial Inc. which is a national debt collection agency specializing in consumer debt collections across different sectors such as timeshare or vacation ownership resorts, educational loans, utility cooperatives, and others.

Top Key Players in the Market

• Aspen National Financial Inc.

• Atradius Collections

• Capital Collections LLC

• Cedar Financial

• Encore Capital Group

• IC System PRA Group

• Prestige Services Inc.

• Rocket Receivables

• Rozlin Financial Group, Inc.

Emerging Trends

The integration of advanced technologies, particularly artificial intelligence (AI) and machine learning (ML), is revolutionizing the debt collection agencies market. AI-powered tools enable predictive analytics, which helps agencies assess debtor profiles and identify the likelihood of repayment. Automated chatbots and virtual assistants are increasingly being adopted to handle routine customer interactions, making the recovery process faster and less intrusive.

Additionally, the use of blockchain technology is gaining traction, offering enhanced transparency and security in transactions, which builds trust with both creditors and debtors. These technological advancements are not only improving efficiency but also enabling agencies to comply with evolving regulatory standards.

Another significant trend is the shift toward customer-centric collection strategies. With growing consumer awareness of their rights and increased scrutiny of debt collection practices, agencies are focusing on empathetic and ethical recovery approaches. Personalized repayment plans and transparent communication are being prioritized to maintain debtor relationships and safeguard brand reputations. This shift is further supported by regulatory mandates in many regions that emphasize fair treatment of consumers, driving the adoption of more compliant and customer-focused practices.

Moreover, sustainability and environmental considerations are also emerging as key trends in the market. Debt collection agencies are increasingly adopting digital solutions, reducing their reliance on paper-based processes and minimizing their environmental footprint.

Cloud-based platforms and remote working technologies are not only streamlining operations but also aligning agencies with global sustainability goals. Together, these trends indicate a future where technology, ethical practices, and sustainability converge to shape the evolution of the debt collection industry.

Major Challenges

One of the primary challenges faced by debt collection agencies is navigating complex and evolving regulatory frameworks. Governments across regions are implementing stricter compliance requirements to ensure ethical debt collection practices and protect consumer rights. Non-compliance can lead to heavy fines, legal actions, and reputational damage for agencies. Moreover, the variation in regulations across countries adds complexity for agencies operating on a global scale, requiring significant investments in legal expertise and technology to ensure adherence to local laws.

Another key challenge is the rising consumer awareness of their rights and the increasing focus on data privacy. Debtors are becoming more knowledgeable about their rights under laws such as the Fair Debt Collection Practices Act (FDCPA) in the U.S. and similar regulations worldwide. This has made it more difficult for agencies to employ aggressive recovery tactics, necessitating a shift toward more empathetic and customer-friendly approaches. Additionally, concerns over the security of sensitive debtor information have become critical, with agencies needing to invest in advanced cybersecurity measures to protect against data breaches and maintain trust.

Economic volatility and the increasing volume of consumer debt also pose significant challenges. During economic downturns, rising unemployment and reduced disposable income lead to higher default rates, making debt recovery more difficult. Additionally, the growing prevalence of buy-now-pay-later (BNPL) schemes and unsecured loans adds to the complexity, as such debts are often harder to collect. These economic pressures force agencies to balance recovery costs with profitability, creating further operational challenges.

Attractive Opportunities

The rising levels of consumer debt globally present a significant opportunity for debt collection agencies. The increasing use of credit cards, personal loans, and buy-now-pay-later (BNPL) schemes, particularly in emerging economies, is driving demand for effective debt recovery solutions.

Moreover, financial inclusion initiatives and expanding middle-class populations are fueling the uptake of credit, creating substantial growth prospects for debt collection services. Moreover, the healthcare and education sectors in these regions are experiencing rising unpaid bills and student loan defaults, further boosting the market potential.

Technological advancements are unlocking new opportunities for market players to improve efficiency and expand their offerings. The adoption of artificial intelligence (AI), machine learning, and predictive analytics allows agencies to segment debtors, prioritize accounts, and optimize recovery strategies.

Additionally, automation tools reduce operational costs and streamline processes, enabling smaller agencies to compete with larger players. The growing integration of blockchain technology ensures secure, transparent transactions, enhancing trust among creditors and debtors. These innovations are also helping agencies comply with increasingly stringent regulatory requirements, positioning them as reliable partners for businesses.

Recent Developments

In October 2024, Neowise has unveiled two industry-first transformative products powered by generative AI: NeoBot, the Debt Collection VoiceBot, and NeoSight, the AI Call Analytics Tool. Neowise is India’s fastest-growing debt recovery solutions provider and a Decentro group subsidiary that contributes to the overarching lending infrastructure.

In March 2024, Skit.ai, the leading provider of Conversational AI solutions for the accounts receivables industry, announced the launch of an innovative suite of multichannel, self-service offerings aimed at enhancing debt collection processes and elevating consumer experiences. The company has introduced a comprehensive range of Generative AI-powered solutions across voice, chat, email, and text communications.

Conclusion

The debt collection agencies market is poised for substantial growth, driven by rising consumer debt levels, advancements in technology, and the increasing demand for efficient recovery solutions across diverse industries. With opportunities emerging in sectors such as financial services, healthcare, and retail, coupled with the integration of AI, predictive analytics, and customer-centric practices, the market is evolving to meet the challenges of a dynamic global economy. As businesses prioritize compliance, ethical practices, and operational efficiency, debt collection agencies are well-positioned to play a pivotal role in ensuring financial stability and sustainability across industries.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release