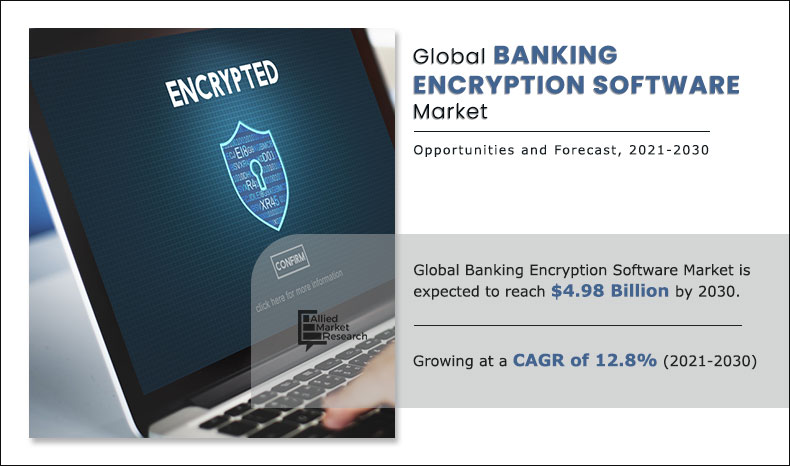

Banking Encryption Software Market is All Set to Reach $4.98 Billion by 2030 | Top Players and Business Strategies

Banking Encryption Software Market 2022

PORTLAND, OREGON, UNITED STATES, January 18, 2022 /EINPresswire.com/ -- Banking encryption software is considered a powerful information security technology which is used by banks to protect customer’s personally identifiable information such as names, addresses, social security numbers, and the credit score from cyber-attacks.

Allied Market Research published a report, titled, “Banking Encryption Software Market by Component (Software and Service) Deployment Model (On-premise and Cloud), Enterprise Size (Large Enterprises and Small & Medium Sized Enterprises), and Function (Disk Encryption, Communication Encryption, File/Folder Encryption, and Cloud Encryption): Global Opportunity Analysis and Industry Forecast, 2021–2030.” According to a report, the global banking encryption software industry size was valued at $1.49 billion in 2020, and is projected to reach $4.98 billion by 2030, growing at a CAGR of 12.8% from 2021 to 2030.

The report offers a detailed analysis of changing Banking encryption software market dynamics, key segments, competitive landscape, major investment pockets, and investment feasibility. These data and statistics will offer a valuable source of guidance for startups, stakeholders, leading market players, and investors to avail useful insights regarding the market and implement necessary strategies.

Download Sample Report (Get Full Insights in PDF - 256+ Pages) @ https://www.alliedmarketresearch.com/request-sample/12189

The research provides an extensive analysis of drivers, restraints, and opportunities of the global Banking encryption software market growth. These insights are useful for determining further strategies and tap on opportunities to achieve sustainable growth. This information and its thorough explanations will also help in knowing driving forces and adopt strategies for realizing growth. Moreover, market players, investors, and new entrants can adopt these insights for identifying the market potential and achieve competitive advantage.

The report provides insights on the impact of the Covid-19 pandemic on the global Banking encryption software market size. These insights would to help in improvising strategies to cope up with the impact. Moreover, market players can reassess their strategies and mitigate the impact caused due to disrupted manufacturing processes, supply chain, and lack of availability of workforce. Investors can adapt their strategies and determine investment feasibility as per the changing scenario.

The report offers a comprehensive segmentation of the global Banking encryption software market share on the basis of type, applications, end users and region. A detailed analysis of each segment and sub-segment is provided in the report with the help of tabular and graphical formats. This analysis is a valuable source of information in determining the largest revenue generating and fastest growing segments. Moreover, these insights will guide in adopting various strategies to achieve growth during the forecast period.

Get detailed COVID-19 impact analysis on the Banking encryption software market @ https://www.alliedmarketresearch.com/request-for-customization/12189?reqfor=covid

The research provides an extensive competitive scenario of the global Banking encryption software market for different regions and respective countries. Regions analyzed in the report include North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, Italy, France, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Taiwan, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). The data and information about these regions and countries are valuable in determining the strategies and exploring market potential. AMR also provides the customization services for a specific region, country, and segment according to the requirements.

The report provides a detailed analysis of key market players operating in the global Banking encryption software market. The leading market players analyzed in the report include Broadcom, ESET, IbM Corporation, Intel Corporation, McAfee, LLC, Microsoft Corporation, Sophos Ltd., Thales Group, Trend Micro Incorporated and WinMagic.

The leading players adopted various strategies such as new product launches, partnerships, joint ventures, mergers and acquisitions, collaborations, expansion, and others to achieve sustainable growth and make an international mark.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/12189

Key Market Segments

By Component

• Software

• Services

By Deployment Model

• On-premise

• Cloud

By Enterprise Size

• Large Enterprises

• Small & Medium Enterprises

By Industry Vertical

• Disk Encryption

• Communication Encryption

• File / Folder Encryption

• Cloud Encryption

By Region

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Netherlands

o Rest of Europe

• Asia-Pacific

o China

o India

o Japan

o Singapore

o Australia

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of Market Research Reports and Business Intelligence Solutions. AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of AMR, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Analytics LLP

help@alliedanalytics.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release