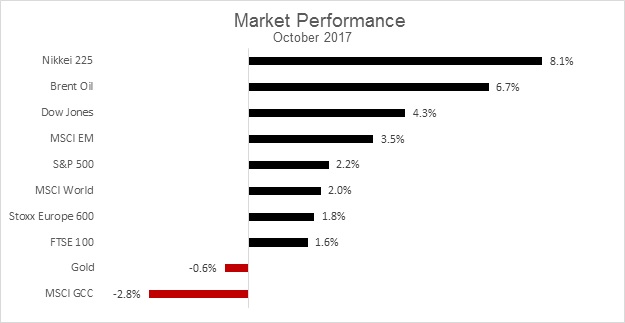

Global Markets Continue Their Positive Performance While the GCC Markets Retreat: NBK Capital Report

Global equities ended the month of October in the green. The MSCI All Country Index was positive at 2.0%. The Nikkei was the largest gainer, hitting new highs after Prime Minister Shinzo Abe’s election victory. US equities ended on a positive note, with the S&P 500 and Dow Jones closing at 2.2% and 4.3%, respectively. European equities continued their winning streak, with the Stoxx Europe 600 closing the month up 1.8% despite news of Catalonia’s declaration of independence. Commodities had mixed performances for the month, with Gold at -0.6% and Brent rallying 6.7%.

In the US, the US Markit Manufacturing PMI, on a preliminary basis, came in at 54.5, slightly higher than last month’s 53.1 while the Markit Services PMI came in slightly lower than expected at 55.3. The labor market continues to be healthy, with Initial Jobless Claims at 233,000, less than market expectations of 235,000. Durable Goods Orders increased by 2.2% in September versus 2.0% in August. Housing starts fell in September by 4.7% from the previous month to 1.1287m, while building permits dropped by 4.5%. In retail, sales grew by 1.6% in September, slightly less than market expectations of 1.7%. Consumer Sentiment was down with a reading of 100.7 in October, slightly below September’s 101.1.

In the U.K., the Markit Manufacturing PMI for October came in at 56.3, slightly higher than last month’s reading of 55.9. The Services PMI also came in higher than the previous month’s reading at 55.6. The Consumer Price Index (CPI) for September came in lower than the previous month with 0.3% versus 0.6%. On a year on year basis, the CPI remained unchanged at a 0.3% increase. Retail sales fell by 0.8% in September compared to a 0.9% increase in August, while October consumer confidence dropped to -10 compared to the previous month’s reading of -9.

UK equities ended the month up 1.6%, as measured by the FTSE 100.

The Eurozone Markit Manufacturing PMI came in at 58.5 for October, slightly lower than the previous month, while the preliminary reading for the Eurozone Markit Services PMI came in at 54.8 compared to last month’s 55.8. Consumer confidence in October remained unchanged from the previous month at -1. The Consumer Price Index on a preliminary basis in October increased 1.4% year on year compared to August’s increase of 1.5%.

European equities closed up for the month by 1.8% as measured by the Stoxx Europe 600.

Japan’s exports in September increased by 14.1% year on year compared to 18.1% in August. Meanwhile, imports year on year in September increased by 12% compared to the prior month’s increase of 15.2%. The Nikkei Manufacturing PMI reading for October indicated continued growth with a reading of 52.8, slightly higher than the previous month’s reading of 52.5. Housing starts, year on year for October, fell by 2.9% compared to September’s drop of 2.0%.

Japanese equities rallied in October, as measured by the Nikkei 225, up 8.1%.

China’s imports, measured in local currency, increased by 19.5% in September, on a year on year basis, compared to the previous month’s increase of 14.4%. Exports also grew during September by 9.0 compared to August’s 6.9%. For the month of September, the Consumer Price Index increased by 0.5% compared to the 0.4% increase in August. On a year on year basis, the Consumer Price Index reported a 1.6% increase, in line with expectations, however lower than the previous month’s increase of 1.8%.

The MSCI Emerging Market Index was green for the month of October, gaining 3.5%. Chinese equities, measured by the Shanghai Stock Exchange Composite, also closed in the green 1.3%.

The majority of the GCC equity markets closed in the red during October. The MSCI GCC Countries Index was down -2.8%. Saudi Arabia’s market was the largest loser at -4.8% followed by Kuwait and Oman each at -2.5%, Qatar at -1.8%, and Bahrain at -0.5%. Both Dubai and Abu Dhabi closed the month with positive performance; Dubai gained 2.0% and Abu Dhabi gained 1.9%. Within the MENA region, Egypt’s equity market, as measured by the EGX 30 posted a gain of 3.3%.

Background Information

NBK Capital

Watani Investment Company KSCC (“NBK Capital”), a leading investment management firm in the region, sets the standard in growth-focused innovative financial products and services. A world-class investment house, NBK Capital’s customer-centric approach provides forward-thinking solutions that address the specific investment needs of clients and investors, institutional customers and high-net-worth individuals.