Dallas Central Appraisal District Increases Residential Property By 15% In 2024 Reappraisal

O'Connor summarized the outcomes of the Dallas Central Appraisal District's reassessment, indicating a 15% rise in residential property values in 2024.

DALLAS, TEXAS, UNITED STATES, May 9, 2024 /EINPresswire.com/ -- Dallas Central Appraisal District 2024 Single Family Increase At 15%

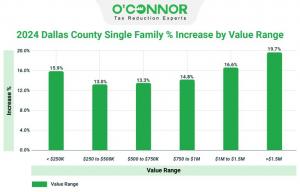

Residential properties valued over $1.5 million had a massive rise, about 20% in Dallas Central Appraisal District. Other residential property categories that have seen significant gains include those priced between $1 million and $1.5 million, which had a 16.6% increase, and those valued between $750k and $1 million, which increased by 15%.

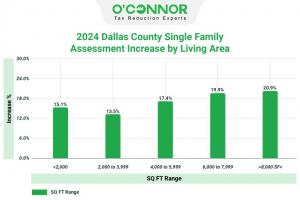

In 2024, the aggregate value of all properties, regardless of their size, increased from $241 billion to $278 billion, indicating a 15% increase. Properties with an area of over 8,000 square feet, which are typically higher value, had a noteworthy rise of 20.9%. The single-family houses in Dallas County with the least gain in value were those that ranged in size from 2,000 to 3,999 square feet, at 13.5%.

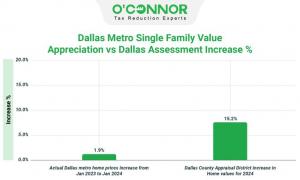

Dallas Metro Single Family Value Appreciation Compared to Dallas County Assessment Increases

According to reports, the Dallas Central Appraisal District increased the value of homes by 15.2% during the 2024 property tax reassessment in Dallas County. The Metro Tex Association of Realtors reported that the Dallas Metro house prices only showed a minimal rise of 1.9% from January 2023 to January 2024.

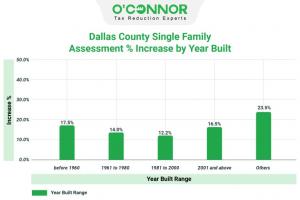

Dallas County Tax Assessments Based on Year Built

During the 2024 property tax reappraisals carried out by the Dallas Central Appraisal District, properties lacking the specified year of construction and categorized as “others” seemed to have received higher assessments in comparison to homes where the year is noted in the account. Their evaluated worth escalated from $128 million to $158 million, signifying a 23.5% surge, however this category of homes is the minority. As the majority of homes clearly define a year of construction, it is more informative to note that the value range with the greatest escalation in value is for homes built before 1960, at 17.5%. Conversely, the smallest growth was seen in the housing market for properties constructed between 1981 and 2000, with a relatively modest gain of 12.2%. Based on statistics from the Dallas Central Appraisal District, the value of houses in the county increased by 15% overall, categorized by the year they were constructed.

The Dallas Central Appraisal District overvalued 52% of Dallas County properties in 2024. The research compares 2023 house sales prices to 2024 property tax reassessments. The 2024 sales price was lower than the 2023 sales at 48%.

Dallas County Commercial Owners Face Shocking Tax Revaluations!

Property owners in Dallas County seem to have had significant rises in their property values in the previous year. The largest increase in property values was seen in warehouses, where values increased by an astounding 46.6%, from $6.3 billion to $9.2 billion. In contrast, collectively the owners of land witnessed a rare drop in value of 0.6%.

When evaluated by year built, commercial properties in Dallas County with the lowest increase in value number compared to other construction year categories is for those built between 1981 and 2000. Those with a watchful eye may point out that there was actually a drop of 2.1% for commercial property with the year built range of “others”. There is no record of the year of construction in the tax account for these properties, however the majority of tax accounts include readily available data about the year of construction. Inclusion of this minority of accounts in the analysis allows us to view the data with greater accuracy, as without these accounts, the overall numbers would appear to be inconsistent. The biggest recorded increase in value is seen in commercial properties established in 2001 and after, with a gain of 22.6%.

Disconnect Between a DCAD Values and Wall Street Bankers

There is a significant disparity between the analysis conducted by Green Street Real Estate, a Wall Street firm, and the 2024 commercial property tax reassessment carried out by the Dallas Central Appraisal District. The Dallas Central Appraisal District reported an almost 19% surge in commercial property values compared to the prior year.

Dallas County Property Increase in Taxable Value by Value Range

In the 2024 tax year, Dallas County’s assessments for commercial properties have seen a substantial increase in most assessed value categories and value ranges. Commercial accounts valued at above $5 million had a growth rate of 20.6%, while property priced below $500K saw a decline of 14%.

Dallas County Apartment Property Increase by Year Built

The combined property tax evaluations for apartment complexes in Dallas County had an increase of around 23.1% in 2024. The most significant surge was seen in apartment complexes built in 2001 and after, seeing a 24.5% appreciation in value from $30 billion in 2023 to $38 billion in 2024. The apartment buildings without a noted date of construction did not have any change in value appreciation, staying constant.

Dallas County Office Buildings Percentage Increase by Year Built

The Dallas Central Appraisal District appears to have made the most significant increase for office property where no data is available for the year built. This “others” category has seen an impressive rise of 28% in property tax assessments, but it is important to realize this is an extremely small portion of the office property appraised in 2024. By value, this category makes up less than a one hundredth of a percent of all office accounts in Dallas County. The year range of offices constructed in 2001 and later show an increase of 15.9%, which is much more meaningful, particularly in light of the fact that offices are facing historic levels of vacancy. The office buildings built between 1961 and 1980 saw the smallest growth, with a rise of just 6.7%. The average growth of assessed value for all categories of construction years has been around 11.8%.

Dallas CAD Retail Tax Assessments Up About 14%

According to the statistics, the property tax assessments for all four ranges of construction for retail buildings in Dallas County have increased in all construction year categories. The retail buildings constructed during the period from 1961 to 1980 saw the highest level of assessment growth, with their value increasing from $3.1 billion in 2023 to $3.6 billion in 2024, representing a 16% surge. The appreciation of retail properties constructed between 1981 and 2000 had a gain of 12.2% this year, which is the least amount of growth in assessed value for this section of analysis.

During the year from 2023 to 2024, the property tax assessment for owners of warehouse buildings in Dallas County had an astronomical average escalation of 46.6%. Warehouse structures constructed in Dallas County from 1961 to 1980 have seen a significant appreciation in their worth. The value of these buildings increased from $1.3 billion to $2.1 billion, representing a 61.7% growth. The market value of warehouse buildings constructed before 1960 has shown a similar rise of 54.8%.

Office Building 2024 Reassessment by Type in Dallas County

In 2024, there was an increase in property tax evaluations for a certain kind of office building in Dallas County. The expansion in office buildings had a significant increase of 12%, whilst medical office buildings only saw a modest 5% rise. The overall evaluation for 2024 has seen a notable growth of around 11.8%, rising from $30 billion to $34 billion.

2024 Apartments Property Tax Revaluation by Type

The property tax assessments for different types of apartment complexes in Dallas County increased in 2024. The frame exterior apartment accounts had the most significant growth, rising from $2.2 billion to $2.9 billion, or a 27.7% surge. The brick exterior apartment saw the smallest growth, ticking up from $58 billion to $71 billion, representing a 22.9% increase.

2024 Retail Property Tax Revaluation by Type

Dallas County’s property tax assessments for retail property categories increased in 2024. The least amount of assessed value gained was for the single tenant, who witnessed a relatively low 9% growth over 2023 assessments. Mall shopping malls have had the sharpest increase in retail properties, at 23.6%.

Dallas CAD Warehouse Revaluations by Type

The Dallas Central Appraisal District determined that the market prices of two types of warehouse properties increased by 46.6% overall. A staggering 56% increase in warehouse building value was noted, from $4.8 billion to $9.2 billion. Property prices increased in the mini warehouse category less, by roughly 16%.

Summary for Dallas CAD 2024 Property Tax Revaluation

Property owners in Dallas County are seeing significant increases in property values for both residential and commercial properties. Dallas County saw stronger reported growth than the Dallas metro area.

Profits from commercial real estate were enormous. The market trends for commercial real estate have been difficult for some and rather unpleasant for others. Many commercial property owners would certainly admit in private talks that the value of their assets has decreased in recent years. Interest rates rose from 1.71% in January 2022 to 4.05% in January 2024, contributing to the current scenario. It is also the result of relatively consistent revenue patterns, along with significant and ongoing increases in casualty insurance and other operational costs.

Appeal Your Property Values Each and Every Year

Property proprietors in Texas, particularly those in Dallas County, possess a legal right and would be wise to contest the evaluated worth of their land. Residential and commercial property owners have the option to provide evidence throughout the appeal process to substantiate their assertion that the assessed value is excessive. Owners should strongly consider initiating an appeal or engaging the services of a property tax consulting organization, since most property tax protests yield favorable outcomes. O’Connor has extensive experience spanning five decades in advocating against the principles upheld by residential and commercial properties. Furthermore, they possess the necessary resources to support their primary objective of enhancing the lives of property owners by effectively reducing taxes at a fair cost.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.